Govt Employees Tax Calculation 1.1

Free Version

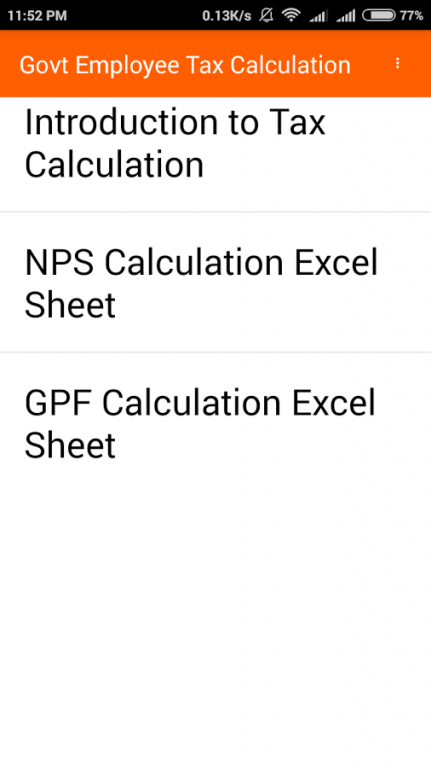

Publisher Description

Calculation your Income tax according to SEVENTH Central pay commission.

Easy to use Tax Calculator for Government employees to calculate Taxes according to 7th CPC

Contains Tax calculation Excel sheets for NPS and GPF.

How much of my HRA is exempt from tax?

The entire HRA received is not always fully exempt from tax. The least of the following three will be taken to exempt from tax:

(i)HRA received from your employer

(ii)Actual rent paid minus 10% of salary

(iii)50% of basic salary for those living in metro cities , 40% of basic salary for those living in non-metro cities

The remainder of your HRA is added back to your taxable salary. Our calculator can easily help you figure out your HRA exemption. So it is least of above three. We in our Excel calculation sheet only mentioned (i) and (ii) as (iii) is very high amount and it is not applicable to government employees.

3. Income tax exemption on children education allowance

(i)Children Education Allowance (CEA) under section 10 (14) read with Rule 2Bb(2)(5) of the Income Tax Act is Rs.I00 per month per child. ( section is applicable for those you claimed children education allowance allowanced up to child.

(ii)Deduction u/s. 80C for tuition / school fees paid for education of children

Who is Eligible: Deduction for tuition fees u/s. 80C of the Income Tax Act 1961 is available to Individual Assessee and is not available to HUF. Deduction under this section is available for tuition fees paid on two children’s education. If Assesses have more than two children then he can claim tuition fees paid of only two children’s. The Deduction is available for any two children.

4. Tax Benefit Home Loan

(i) Section 24: Income Tax Benefit on Interest on Home Loan

Tax Benefit on Home Loan for payment of Interest is allowed as a deduction under Section 24 of the Income Tax Act. As per Section 24, the Income from House Property shall be reduced by the amount of Interest paid on Home Loan where the loan has been taken for the purpose of Purchase/ Construction/ Repair/ Renewal/ Reconstruction of a Residential House Property.

The maximum tax deduction allowed under Section 24 of a self-occupied property is subject to a maximum limit of Rs. 2 Lakhs (increased in Budget 2014 from 1.5 Lakhs to Rs. 2 Lakhs).

(II) Section 80EE: Income Tax Benefit on Interest on Home Loan (First Time Buyers)

While announcing the Budget 2016 re-introduced Section 80EE which provides for additional Deduction of Rs. 50,000 for Interest on Home Loan. This incentive would be over and above the tax deduction of Rs. 2,00,000 under Section 24 and Rs. 1,50,000 under Section 80C.

This Deduction of Section 80EE would be applicable only in the following cases:-

This deduction would be allowed only if the value of the property purchased is less than Rs. 50 Lakhs and the value of loan taken is less than Rs. 35 Lakhs.

The loan should be sanctioned between 1st April 2016 and 31st March 2017.

The benefit of this deduction would be available till the time the repayment of the loan continues.

This Deduction would be available from Financial Year 2016-17 onwards.

(III) Section 80C: Tax benefit on Home Loan (Principal Amount

The amount paid as Repayment of Principal Amount of Home Loan by an Individual/HUF is allowed as tax deduction under Section 80C of the Income Tax Act. The maximum tax deduction allowed under Section 80C is Rs. 1,50,000. (Increased from 1 Lakh to Rs. 1.5 Lakh in Budget 2014)

Tax Benefit

The investor will be eligible to get a 50% deduction of the amount invested from the taxable income of that year u/s 80CCG. The benefit is over and above the deduction available u/s Sec 80C.

Lock-in Period

The whole lock-in period for investments under the RGESS can be divided into 'fixed lock-in period' and 'flexible lock-in period'.

About Govt Employees Tax Calculation

Govt Employees Tax Calculation is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops Govt Employees Tax Calculation is Subhom Developers. The latest version released by its developer is 1.1.

To install Govt Employees Tax Calculation on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2017-01-15 and was downloaded 12 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Govt Employees Tax Calculation as malware as malware if the download link to subhom.govtemployeesincometaxcalculator is broken.

How to install Govt Employees Tax Calculation on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Govt Employees Tax Calculation is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Govt Employees Tax Calculation will be shown. Click on Accept to continue the process.

- Govt Employees Tax Calculation will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.